how much tax is taken out of my paycheck indiana

Please enter information about your employees federal tax filing and withholding status. Indianas statewide income tax has decreased twice in recent years.

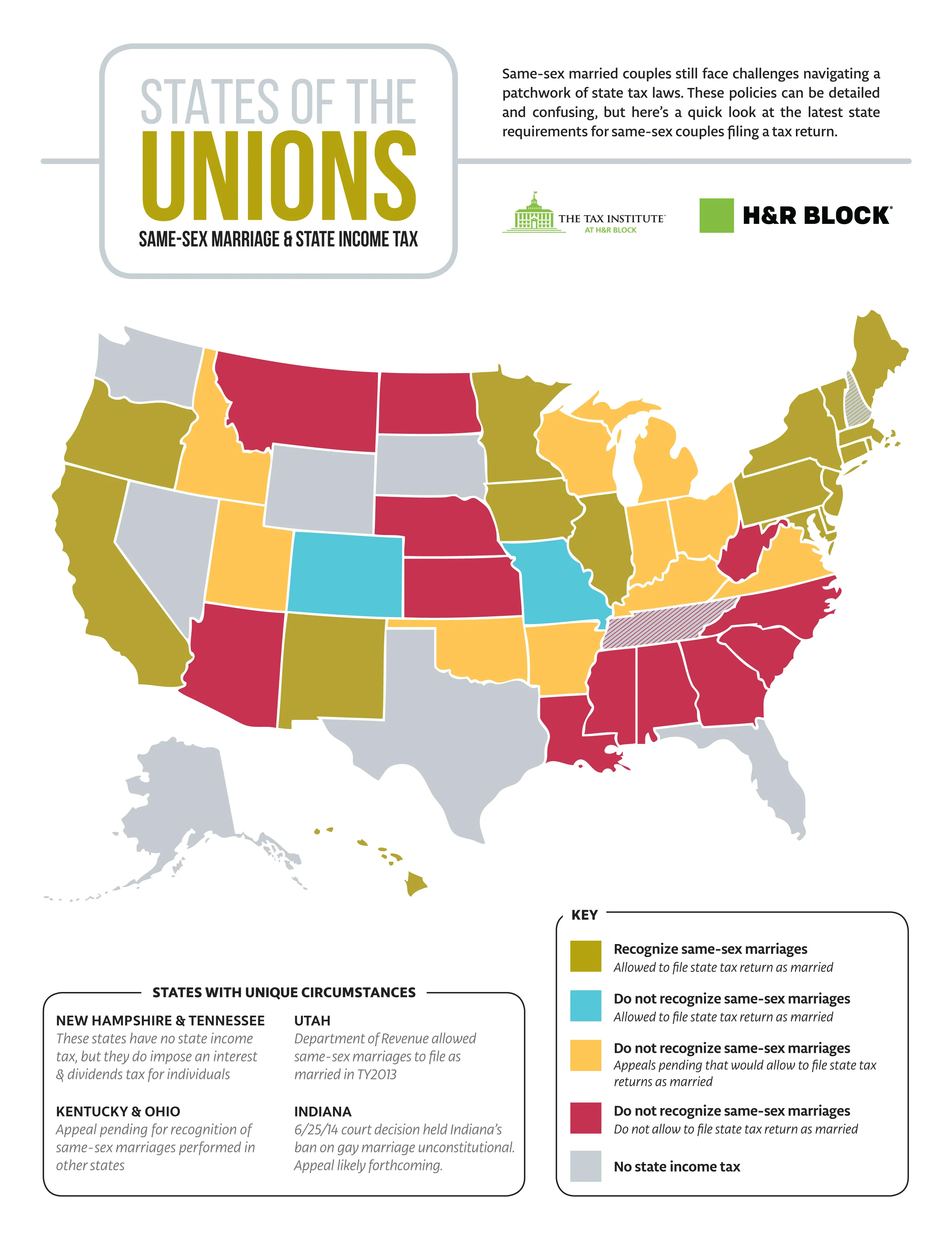

Why Same Sex Couples Need A Good Accountant More Than Ever Money

Switch to Indiana hourly calculator.

. The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. Medicare and withholding taxes for all 50 states. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Indiana Hourly Paycheck Calculator. 8 New or Improved Tax Credits and Breaks for Your 2020 Return. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The calculator will estimate how much tax is taken from your paycheck in Indiana. FICA taxes consist of Social Security and Medicare taxes. Total income taxes paid.

All 92 counties in the Hoosier State also charge local taxes. So the tax year 2022 will start from July 01 2021 to June 30 2022. Important note on the salary paycheck calculator.

For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income. Figure out your filing status.

The states general sales tax is high though municipalities dont get to add to it. Those rates taken alone would give. You must also match this tax.

Switch to Indiana salary calculator. Estimate your federal income tax withholding. Indiana Salary Paycheck Calculator.

081 average effective rate. Whats your employees federal filing status 1c. The Indiana Paycheck Calculator will help you determine your paycheck.

As an employer you must match this tax dollar-for-dollar. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck calculator. All you need to do is enter the necessary information from the employees W-4 form pay rate deductions and benefits.

Use this tool to. The Hoosier State dropped its flat income tax a smidge in 2017 from 33 to 323 but many counties in Indiana also impose their own income taxes with an average levy of 156 according to the Tax Foundation. You are able to use our Indiana State Tax Calculator to calculate your total tax costs in the tax year 202223.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. These local taxes could bring your total Indiana income tax rate to over 600 depending on where you live. Remember that whenever you start a new job or want to make changes youll need to fill out a new W-4.

32 cents per gallon of regular gasoline and 53 cents per gallon of diesel. Supports hourly salary income and multiple pay frequencies. These amounts are paid by both employees and employers.

What are the payroll taxes in Indiana. Some states follow the federal tax year some states start on July 01 and end on Jun 30. Similar to the tax year federal income tax rates are different from each state.

The amount of federal taxes taken out depends on the information you provided on your W-4 form. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status.

This Indiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. How Your Indiana Paycheck Works. The calculator on this page is provided through the ADP.

W4 Employee Withholding Certificate The IRS. Choose an estimated withholding amount that works for you. This free easy to use payroll calculator will calculate your take home pay.

The state tax year is also 12 months but it differs from state to state. Total income taxes paid. You can also use the calculator to find out what taxes youll have to.

For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. It went from a flat rate of 340 to 330 in 2015 and then down to 323 for 2017 and beyond. FICA taxes are commonly called the payroll tax.

Amount taken out of an average biweekly paycheck. Results are as accurate as the information you enter. Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Your average tax rate is 217 and your marginal tax rate is 360. Our calculator has been specially developed in order to provide the users of the calculator with not only. Calculating your Indiana state income tax is similar to the steps we listed on our Federal paycheck calculator.

For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. Multiple jobs 2c optional Dependent total 3 if applicable Other income 4a optional Deductions 4b optional. Amount taken out of an average biweekly paycheck.

See how your refund take-home pay or tax due are affected by withholding amount. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. However they dont include all taxes related to payroll.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. You can find this information on your employees W-4. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

How Much Will My Paycheck Be After Taxes In Colorado Town Of Douglas Ma

How Much Money Gets Taken Out Of Paychecks In Every State Gobankingrates

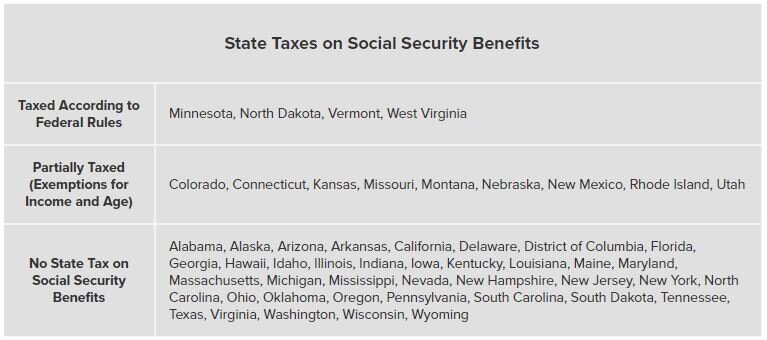

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Us Cities With The Lowest Cost Of Living

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

How Many Tax Allowances Should I Claim Community Tax

How Much Money Gets Taken Out Of Paychecks In Every State Gobankingrates

How Many Tax Allowances Should I Claim Community Tax

How Much Money Gets Taken Out Of Paychecks In Every State Gobankingrates

Us Cities With The Lowest Cost Of Living

Lottery Tax Calculator Updated 2022 Lottery N Go

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Taxes On Paycheck Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive Parts

Pennsylvania Paycheck Calculator Smartasset

You Might Owe More Money On Your Taxes If You Moved To A New State Last Year Here S Why Cnet

How Much Is 300 000 A Year After Taxes Filing Single Smart Personal Finance